I spent the weekend in Bethany Beach, Delaware, with my extended family. Bethany is a typical East Coast beach town, although it's a bit more modern and upscale than most. Ocean-front houses are to be had for $6.9 million, and teardowns off the beach go for about a million and a half.

On weekends, you will find the D.C. lobbyists and other assorted Beltway bandits at the crab houses or taking their kids for frozen custard on the boardwalk.

My niece, who graduated from college in May, was talking about how her job was put on hold due to the writers strike. She majored in television production or something along those lines. My brother, who happens to work for UPS, was delayed a day due to the fallout from the teamster strike. And today’s news is that the United Auto Workers are threatening to strike when their contract ends on September 14.

“A lot of strikes these days,” I commented as we sat around the picnic table, sipping lemonade on the screened porch.

“It’s inflation,” my father replied. “The companies are hard-pressed with rising costs and don't want to give out wage increases. And the workers feel that everything is getting more expensive and their paychecks are not keeping up. And so they fight.”

That is as good as any definition of what economists call a “wage price spiral.” Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

Wall Street

The current Wall Street narrative is that the Federal Reserve started raising rates last year to fight inflation — and it worked. Yes, rates are high, but inflation has dropped from over 9% to 3.2% as reported last week in the CPI report. The market went up in response to the news.

The problem with this story is that we are talking about the headline number. Yes, it peaked in June 2022 and has since fallen. However, the core inflation number, which is near 5%, hasn’t dropped as quickly. The core number excludes food and energy, which, by the way, are going back up again.

WTI is now over $80 and climbing. Gas prices are over $4 a gallon. A hamburger in a restaurant is commonly over $15 and heading to $20.

Milton Friedman said inflation is always and everywhere a monetary problem. During the COVID lockdowns, our government printed and spent $10 trillion.

This was followed up in March 2022 by a $2 trillion spending bill called the Inflation Reduction Act, a name that only makes sense when you realize that all bills coming out of Washington are named for the exact opposite of what they accomplish. See the Patriot Act, Affordable Care Act, etc.

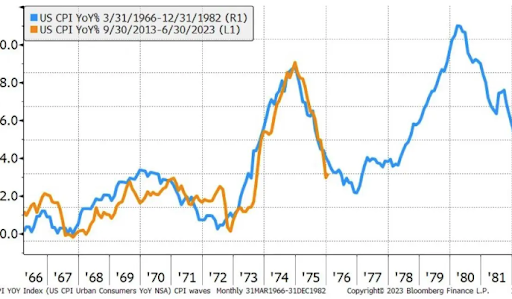

This brings us to a chart put out by Bloomberg. Like most things, inflation doesn't move up and down in a straight line. This chart shows inflation from 1966–1982 overlaid with inflation from the past 10 years.

Inflation seemed to be under control in 1976 but then took off again. It was finally brought under control when the Fed raised rates to 20% in 1980. This broke the economy and loosened the labor market, thus ending the wage price spiral.

It is possible we are headed this way again. One inflation hedge is gold. In 1970, the price of gold was $36 an ounce. In 1980, it topped out at about $915 an ounce.

All the best,

Christian DeHaemer Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.